A look at what influences your car insurance premiums as well as what factors you can influence to keep your premium as low as possible.

One person's car insurance premium will almost always be different from the next. The reason? Every person is different, and every insurer differs in the way they calculate their clients’ premiums.

What factors specific to you influence your car insurance premium

The chances of your car being stolen, written off or damaged by Mother Nature are not the same as those of someone else who lives in an entirely different part of the country, drives a different car and has a different personality. It wouldn’t seem fair if insurers just charged the same premium to everyone regardless of whether you drive a Volkswagen Polo or a Ferrari California!

Therefore, insurers first like to get to know you a bit before giving you your premium. They ask questions like how old you are, where you live, where you work, what car you drive, etc. This is so they can give you a price that reflects your risk as a driver. Here’s a deeper look at why these factors are important:

The car you drive: Typically, more expensive vehicles attract higher premiums as they will cost more to repair or replace. Older cars might also cost more as the parts to repair them might be few and far between, so sourcing them can become tricky. This increases the likelihood that the car is irreparable after an accident and usually results in a claim for the full car value.

Use of your car: Your insurer will want to know what you use your car for. A car used to drive to clients and meetings most days poses a higher risk than a car that is used just to drive to work and back. This is because driving for business generally means spending more time on the road, which means you’re at a greater risk of having an accident. Accordingly, personal use costs less than when you use your car for business.

How long you have had your driver’s licence for: Evidence has shown that relatively inexperienced drivers are at greater risk of getting into an accident. The main reason is that they have not developed a high level of judgement that one can only get by spending lots of time on the road facing different situations.

Your claim record: The number of claims you’ve had in the past is taken as an indication of how many claims you are likely to have in the future. For example, a driver with five accident claims in the past 12 months is seen as being more likely to have a claim in the next 12 months, compared to a person with zero claims in the last 12 months.

So keep in mind that the longer you go claim-free, the lower your premium will be. And if the claim is small enough that you can cover it yourself easily, it might make more sense in the long run not to file the claim with your insurer.

The number of years of uninterrupted car insurance: The longer you’ve had car insurance (with any provider), the better your premium will be. The reason for this is twofold:

Firstly, if you regularly have breaks in your cover, there is a chance that you are only buying cover again when your risk of claiming increases, for example when you are going on a road trip.

Secondly, continuous cover means that the insurer has a clearer picture of your risk over a longer, ongoing period – this makes your claims history more reliable when calculating your premium.

Drunken driving and forced cancellations by your insurer: Insurance companies generally ask if you have ever been convicted of drunken driving or if an insurer has ever cancelled your insurance for reasons other than non-payment. Again this information gives them insight into your driving behaviour and your likelihood of claiming.

Location and security measures: Insurers usually also ask for your postal code so that they can gauge the traffic density of the area you live in – this affects your likelihood of having an accident. They might also ask if you live in a gated area, where your car sleeps at night and if it has a tracking device. Your answers to these questions will allow them to form an idea of the risk of your car being stolen.

Type of car insurance you buy: Several bad things can happen to your car: it can be stolen, damaged or written off. The cost of your premium depends on what bad things you want covered. There are three main types of car insurance that you can buy. Each type varies in level of cover and what you’ll get out if you ever need to claim.

Comprehensive cover: It costs the most, but offers the most protection Comprehensive cover covers you for loss or damage to your vehicle that is caused by hijacking, theft, hail, storms, fire, lightning, explosions, malicious damage or accidental damage. You will also be covered if you are liable to pay for damages from an accident where someone’s property is damaged by your car. There are also optional extras (like car hire and credit shortfall cover) that you can add to your comprehensive cover that will affect your monthly premium.

Third party, fire and theft: Excludes any accidental damage to your car The premium for this cover will be lower than comprehensive cover as your car is only covered for loss or damage caused by hijacking, theft or fire. You will also be covered if you are liable to pay compensation or expenses from an accident where someone’s property is damaged by your car.

Third party liability cover: the most basic form of cover Third-party liability offers basic protection when it comes to owning a car and is also the cheapest cover to buy. Think of it as protection for everything that your car might damage while you are driving it, except for the car itself.

‘Third-party’ refers to the person who holds you responsible for damage caused to their property by your car. Third-party liability will cover the costs when the third party lays a claim against you.

The excess you choose: Your excess choice is another big factor that can influence your car insurance premium. A lower excess means a higher premium, and vice versa.

The value your car is insured for: Insurers either insure your car for retail, market (lower than retail) or trade value (lower than market). The amount that your car is insured for will influence the cost of your premium.

How the insurer you choose influences your car insurance premium

The premium that the insurer sets takes all of the above factors into consideration when assessing your risk (the expected value of your future claims).

But simply charging the correct amount to cover the expected costs of your claims in any one month won't be sufficient to enable the insurer to pay their staff and run their business. Insurers include an additional amount to ensure they can cover their running costs and some profit for shareholders.

Here’s a breakdown of possible running costs. Keep in mind that it varies from insurer to insurer, but these are generally the main factors that influence running costs:

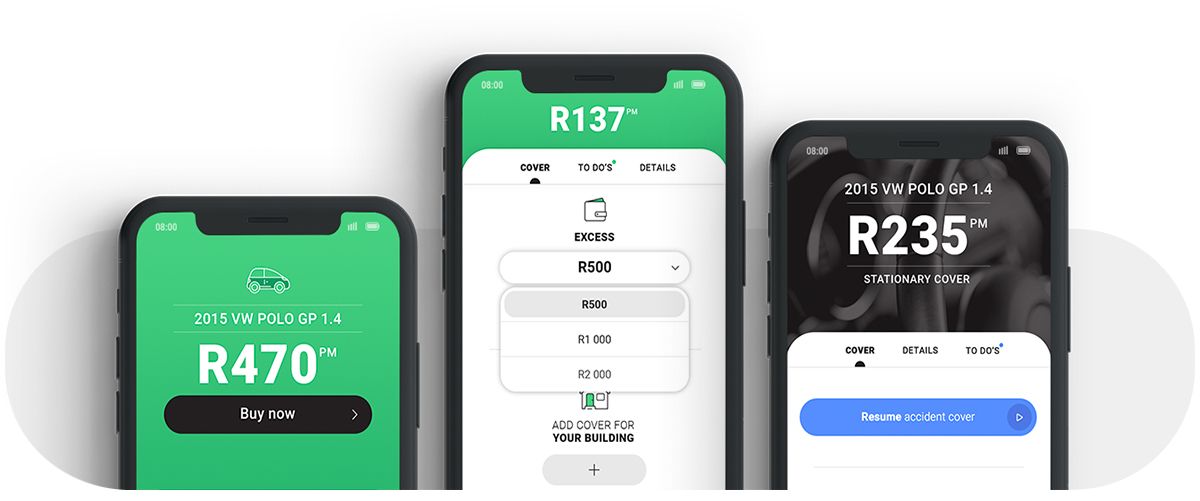

- How policies are sold: If you need to go through a broker or a call centre the cost will be considerably higher than if you can only buy your policy directly online like with Naked.

- The use of technology to service policies and claims: For example if you need to call in to make any changes to your policy or to submit a claim rather than making the changes yourself on an app, the cost of servicing your policy will be much more.

- Cash back benefits: If you are said to receive any rewards for not claiming there will be a loading added to your premium for the expected cost of any such payout.

- Tax: A loading for value added tax.

- Profit: To make sure that insurers can pay your claims if something bad happens, they need to hold a certain amount of capital on their balance sheet by law. Just like with any investment, the providers of this capital need a return. So your premium will be increased with an amount to allow for this required level of return. In essence, their return = premium - claims - expenses.

When it comes to your insurance premium, there are some factors that you just can’t control, but there are some that you could influence to get the best premium possible. Get quotes from a diverse range of insurance providers and do this frequently to make sure you’re getting the best price available for a product that suits your needs.

P.S. At Naked, we believe in providing a product that’s easily accessible and affordable. The tech and methods we’ve chosen are there to empower our clients to have full control over their own policies and, in turn, keep prices as low as possible. Check it out for yourself by doing a simple quote in 90 seconds and buying cover there and then if you like the price.